Digital Transformation Is a Scam

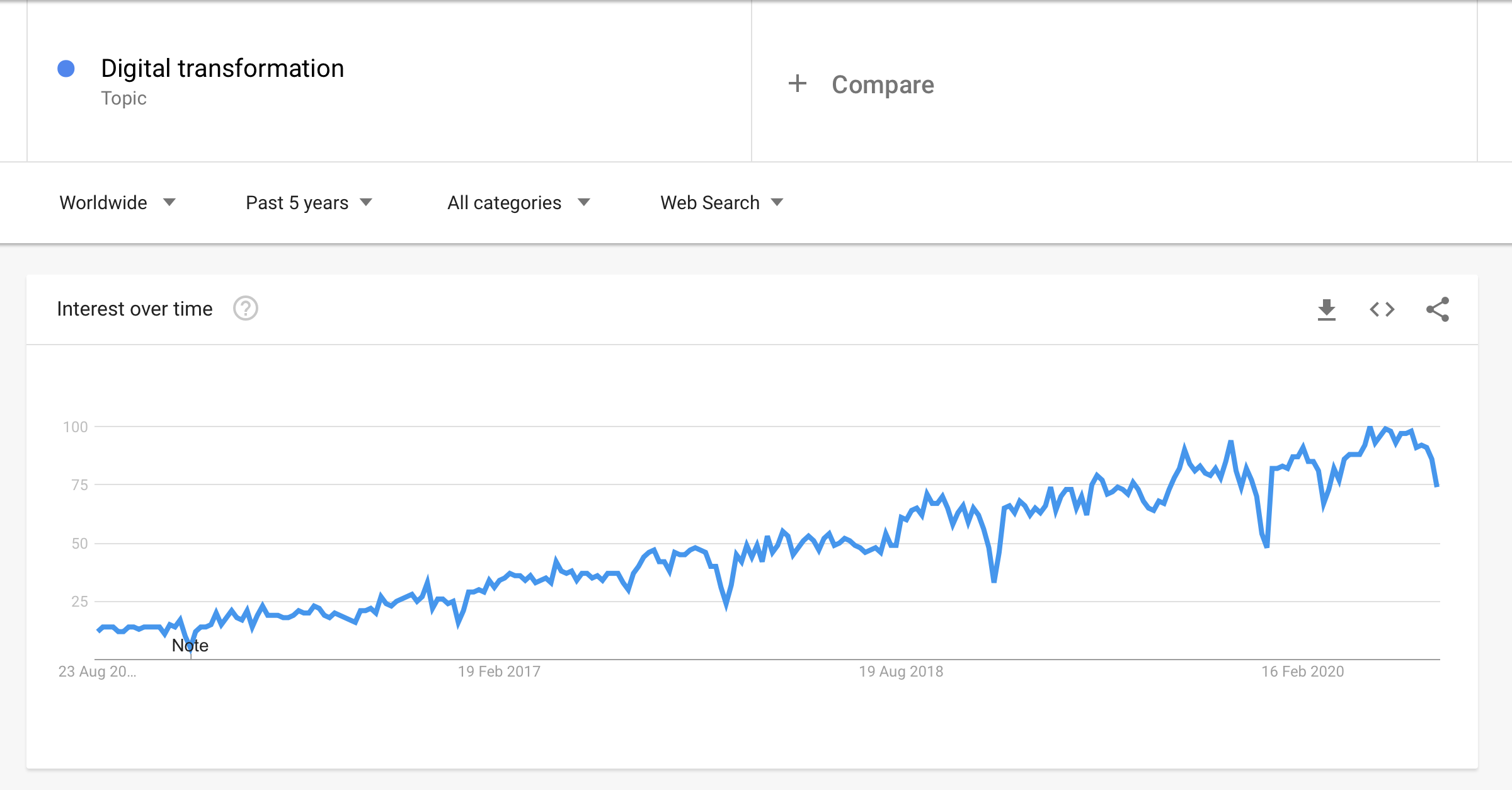

Digital transformation is the future. It’s everywhere. It’s a seemingly unstoppable trend. A force of nature, if you will. Prestigious consultancies like McKinsey, mundane IT service providers like Accenture, and true digital giants such as Google, Amazon, and Microsoft all sell billions of dollars of “digital transformation” each year.

And in terms of transformation, it’s all a scam.

But We’re Using Software

Migrating data centers from an office park in rural Saxony into the cloud? That’s not digital transformation.

Deploying an online portal that allows customers to upload claims instead of contacting the call center and mailing them in? Nope. Not digital transformation.

Delivering software updates to hearing aids “over the air”? Not digital transformation.

While these examples can all make sense and constitute prudent uses of resources with a positive return on investment, they all miss the point of digital transformation. In fact, they miss it by a mile.

On the positive side, the vendors do provide beautiful caterpillar-to-butterfly-infographics. Thank you, Accenture.

Three Phases of Technology

Every new General Purpose Technology, such as the internet, passes through three phases. First, it is used to cut costs. In the second phase, it is utilized to boost revenue and improve the customer experience. Finally, technology’s role is to create business model innovation.

Real transformation only happens in the third phase.

If your job title has “digital” in it, you’re in the wrong industry

Today, I see whole industries stuck in the first phase. Talk to a “digital manager” in a large industrial company or a bank to see for yourself. The topics on his or her mind will mostly be cost-related. This manager will be excited about self-service and automation. In times of global crises, would you expect this manager’s company to progress to the transformation phase? I certainly don’t.

Successful transformation only happens from a position of strength, and when the company has the time and foresight required to execute it. When an external crisis forces a reaction, people usually turn to solutions they know have worked in the past. They choose the conventional way forward.

This is one reason why one of my personal investment theses is to invest in challengers vs. trying to build B2B suppliers for incumbents. Challengers attack incumbents, often indirectly, starting from a very small niche but with a clear long-term view on how to take on the whole industry. I’m convinced that the impact of building challengers and the expected payoff are both profoundly larger compared to the supplier approach. The reason lies in the power of real digital transformation.

Building Tesla is much more promising than aiming to become a Tier 1 supplier to Volkswagen.

Terraforming Industries: A Better Way to Think About Transformation

Whereas the examples above were all concerned with individual business, real digital transformation aims to change the structure of the industry, its very territory.

Digital transformation is an act of terraforming.

Terraforming reengineers planets to create conditions that are perfectly suited for a specific use case and life form.

Terraforming does not work on any planet. Transforming a gas giant such as Saturn into an Earth-like planet is not possible. According to NASA, we don’t yet know how to terraform even planets that seem transformable and inspire our imagination, such as Mars

Did a technology become available that would allow you to cross a mountain that was insurmountable so far?

— On Choosing the Right Terrain and the Difference Between Diminishing and Increasing Returns

The same thing applies to markets. At any point in time, some markets just can’t be transformed. A real opportunity arises when conditions change. Changes in technology, consumer or supplier sentiment, seasonality, or regulation can open up possibilities to transform an industry.

Take the last platform shift. The proliferation of smartphones in combination with ubiquitous mobile broadband made the transformation of the taxi or food takeout industry possible.

On top of the advances in the user interface, screen, and sensor technology, companies such as Peloton emerged that are distinct from previous versions of home fitness equipment or gyms.

The results of successful industry transformation today are most visible from the shift that happened 15 to 20 years ago with the proliferation of the internet. Companies such as Amazon or Booking.com had many years to develop and shape their industries.

How did it play out?

What Successful Digital Transformation Looks Like

Let’s look at four large industries and use market capitalization as a proxy for success and positional strength. We’ll look at the retail, travel, pharmaceutical, and consumer staples markets.

Transformed 1: Retail Market

Even before the dot-com bubble, Amazon was heralded as a real online success story. Jeff Bezos’s ambition to transform retail was clear from the start. That’s why the smile in the Amazon logo goes from A to Z.

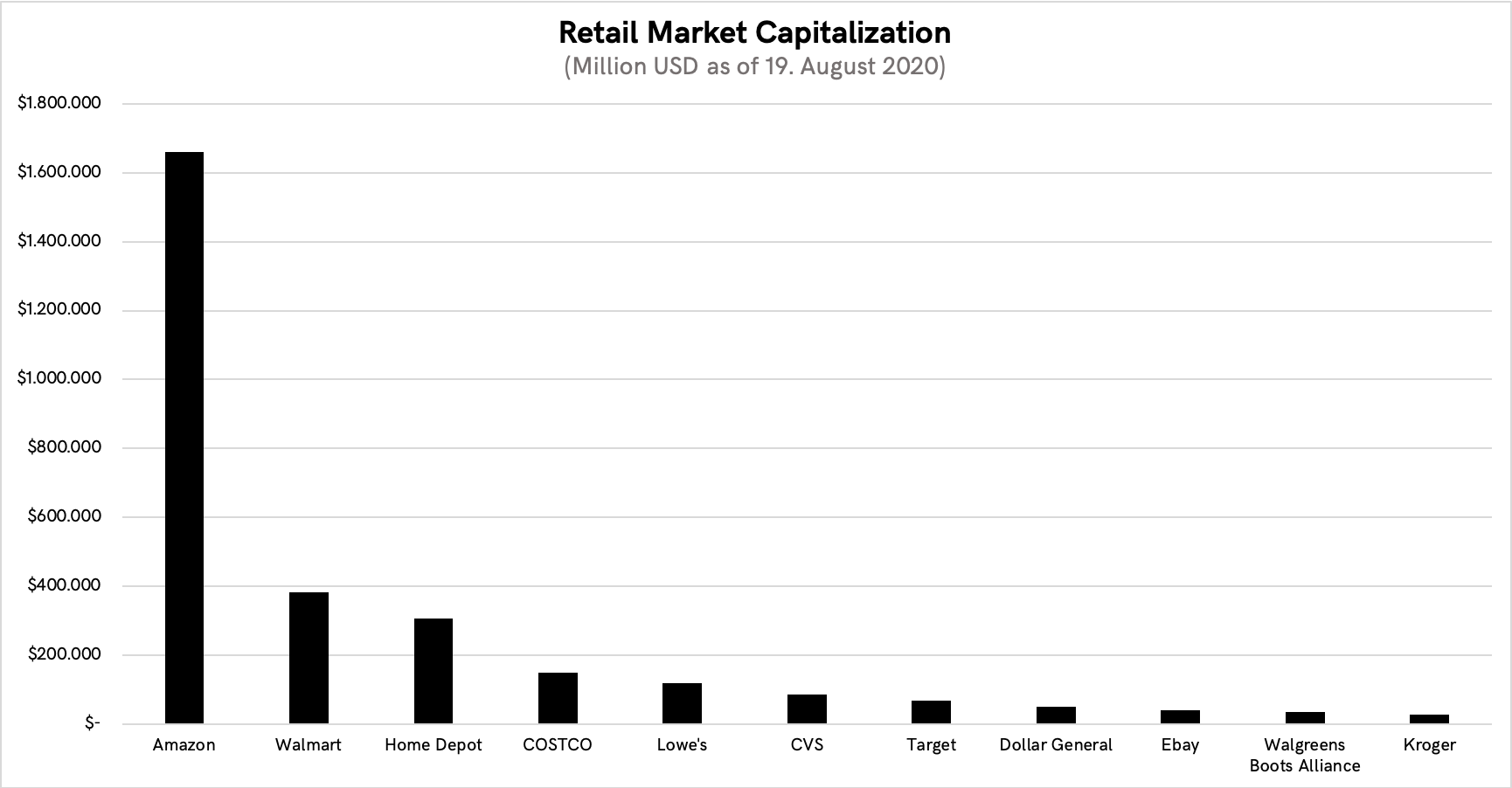

In addition to strategic foresight, Amazon has executed its digital transformation almost flawlessly. This is why Amazon’s current market cap is larger than that of the next 10 companies combined.

Transformed 2: Travel

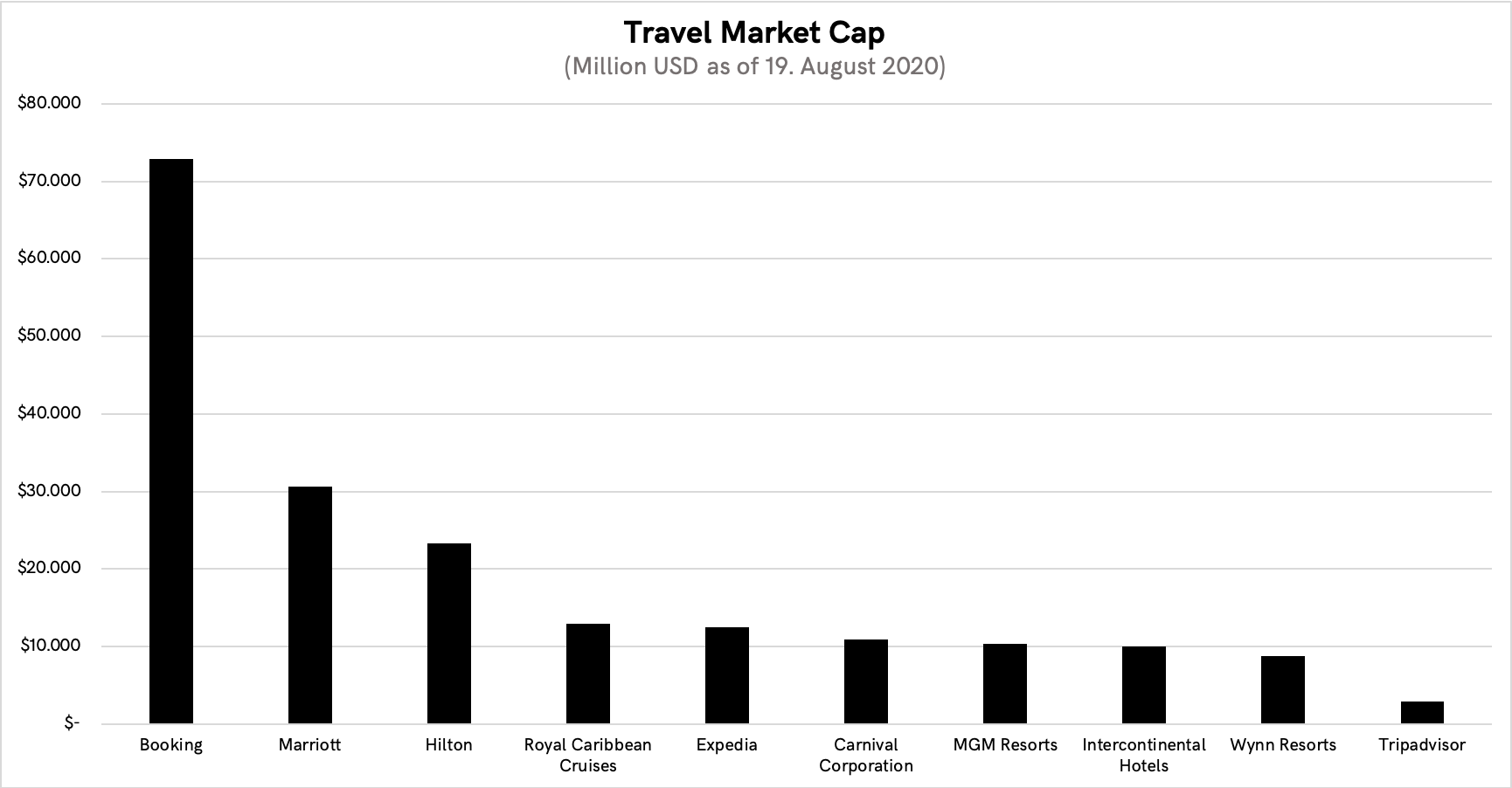

Booking Holdings has transformed the travel industry over the same timeframe as Amazon. A public company since 1999, it now provides access to almost 30 million properties on its marketplace.

In terms of market cap, it is about as large as the next four travel companies combined.

Are the travel and retail markets unusual in their concentration of the largest player? Or do most industries disproportionally reward the leader? To find out, let’s look at two industries that have not been transformed.

Not (Yet) Transformed 1: Pharmaceuticals

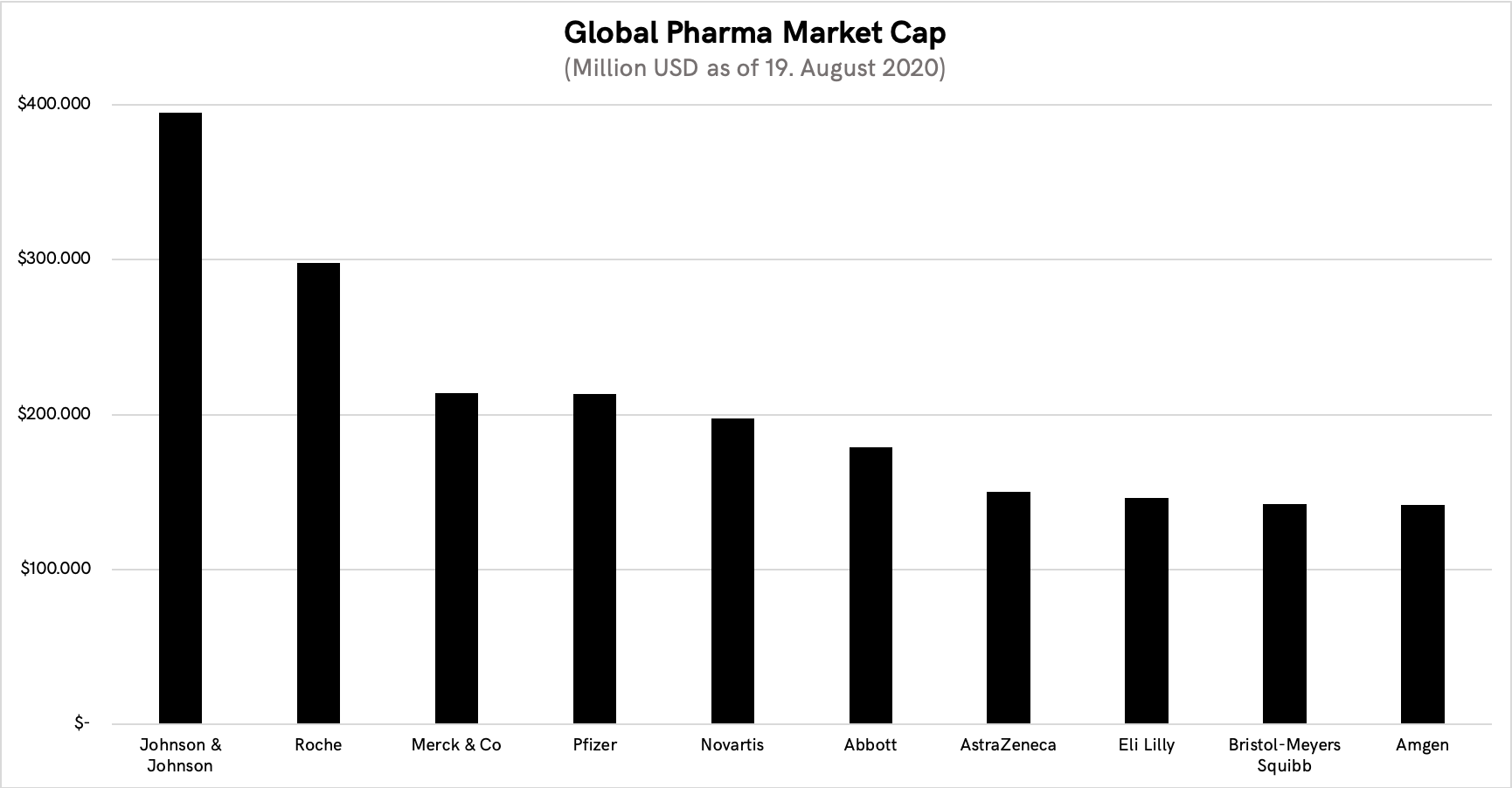

I have been involved with many leading pharmaceutical companies in recent years, and I can tell you that this industry has just started to use digital tools to cut costs and, cautiously, to improve customer experience.

In Pharma, the market leader, Johnson & Johnson, has a market cap only 27% larger than that of number two, Roche. The following companies are all fairly similar in size. Looking at the chart, I would say that it’s still possible for all of them to catch up to the leader. This chart feels quite different from the one we saw in retail.

Let’s look at another example: consumer staples.

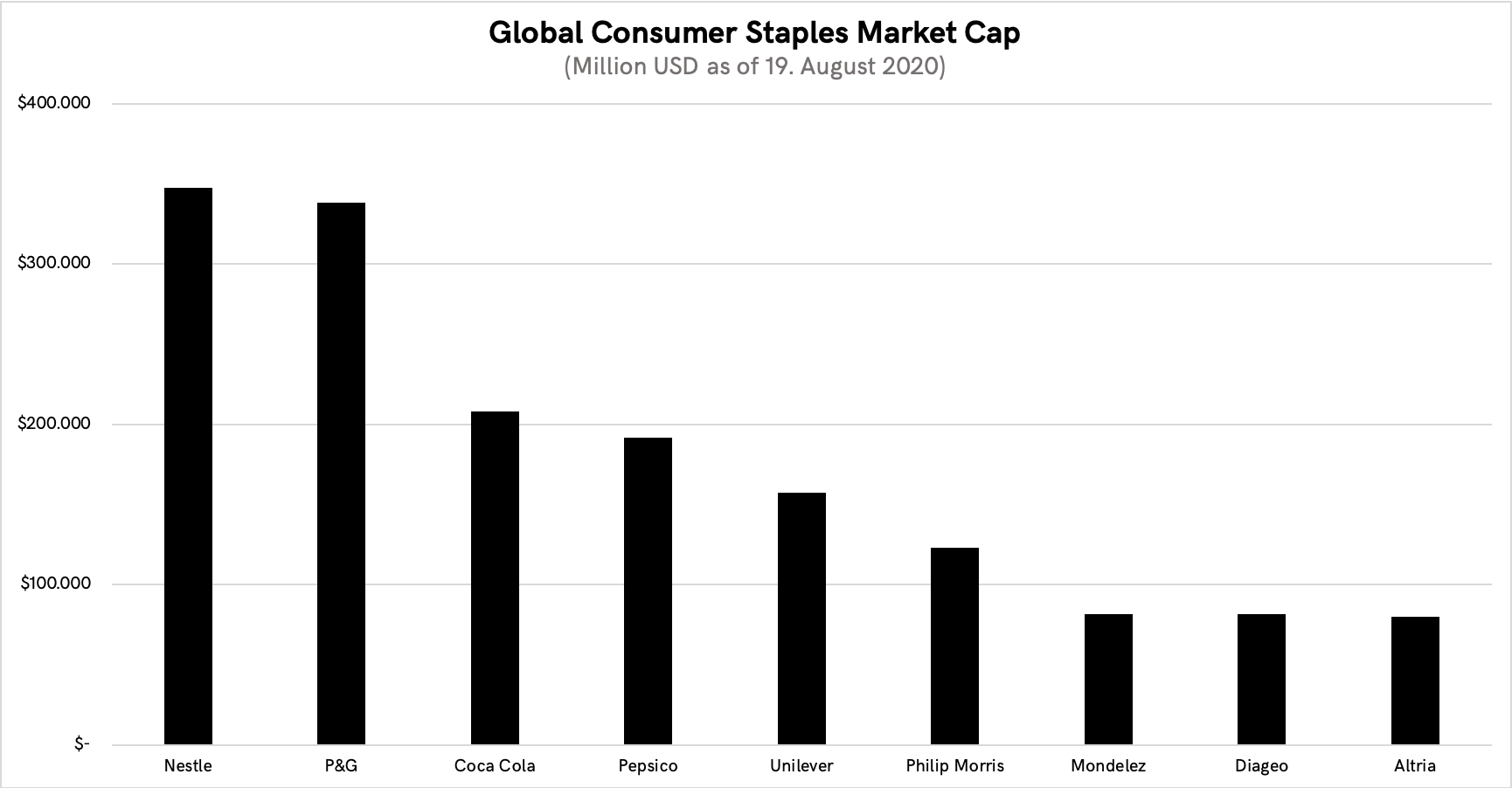

Not (Yet) Transformed 2: Consumer Staples

We’re all familiar with the products of these iconic companies.

Here we see a similar pattern as in Pharma. The leader, Nestle, has a market cap only 7% larger than that of Procter & Gamble. The companies ranked 3 to 6 are also all quite similar in terms of size. Again, there is no clear leader, and this chart looks very different from the retail and travel charts.

The following tables provides a summary of the relative position of the market leader in each of the four markets.

|

Market

|

Market Cap #2 / #1

|

Market Cap #5 / #1

|

|---|---|---|

|

Retail |

23% |

7% |

|

Travel |

42% |

17% |

|

Pharmaceuticals |

75% |

50% |

|

Consumer Staples |

97% |

45% |

The Real Goal of Digital Transformation

Real transformation happens when a new business model transforms an entire industry from competition into power-law by deploying increasing returns components.

Let’s take this summary apart.

We’ve seen above that the retail and travel markets exhibit a power-law distribution as measured by market capitalization. Pharma and consumer staples, on the other hand, are markets where the top companies are much more similar in size.

At some point, real digital transformation will yield a similar market cap distribution in the pharmaceutical and consumer staples industries.

This kind of transformation is the result of the application of increasing returns to scale. This leads to a dynamic where the leader’s product or service is getting better, with increasing size leading to faster growth. These effects go beyond the economies of scale, scope, and branding effects that all large companies use. In the digital realm, examples include network effects or services that can only be offered on top of a large database.

In order to realize this kind of transformation experience in technology is the key. Industry experience is also necessary, but constitutes a far smaller part of the puzzle.

This is why, in most cases, transformation comes from an outsider entering an industry and not from the inside.

Starting from scratch also affords you the advantage to design the culture necessary to realize the transformation from the get-go. The culture that fits companies used to diminishing returns to scale on the demand-side or high competition is quite different from the culture required to build a differentiated, increasing-returns business. The differences encompass the people required, leadership principles, and focus. You’ll find a comprehensive review of the cultural differences in one of my previous essays.

Culture is one of the keys to real digital transformation. A startup, according to Peter Thiel, is the largest group of people you can convince of a plan to build a different future. In contrast, a corporation is the smallest group of people you need to maintain the status quo.

What you often find in these corporates is a culture that acts as an immune system fighting all change. With an increasing number of processes and SOPs, all innovation happens by committee and is driven by formalism (e.g., Design Thinking), which doesn’t work for transformation.

What real transformation teaches us is that there can be real diseconomies of scale. In terms of incentives, the more legacy corporates have invested in their core business, the harder it is to establish a unit that has any chance to fully cannibalize the parent.

In a world driven by faster change, more unbundling of work, more leverage through better tools, and scalability available to individuals, one cannot help but wonder whether the disadvantage of legacy corporations is too large. Are the 20th-century style monolithic entities quickly losing their raison d’être?

Whenever you hear or read anything about digital transformation, think about whether or not it can be used to transform an industry. And when you see the right changes in your industry, go after them. Take the lessons learned from the successful transformers of the last 10 years and apply them to reimagine your industry.

A special thanks goes to my friend Christian, who not only edited an early version of this essay but was also kind enough to lend me his copy of the E-Boys book.