2020s Bubble Speculation for Fun and Potential Profit (Or Loss)

Stocks and real estate are expensive, pre-seed Angel ticket valuations are high, and bank accounts pay negative interest.

So what’s the best way to burn earn some alpha over the next 10 years?

Those of us who missed the biggest bull run in history that were the last 10 years and are fortunate enough to have money to invest are nervously inspecting their portfolios and bank accounts.

There’s one question burning in our minds: Where’s the alpha?

Financial Bubbles

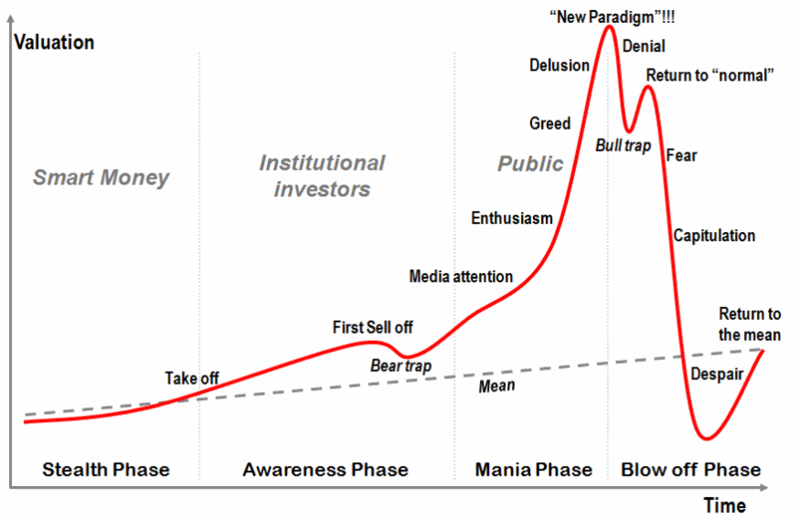

Riding bubbles is the best way to generate quick returns. When prices rise at breakneck pace and reach an unsustainable and unjustifiably high level and you sell near the peak, you can make 10 times your money in less than one year!

The challenge, of course, is buying into bubbles early.

Looking ahead, what sectors might have what it takes to develop a bubble over the next 10 years?

I’d like to make it clear that I’m not interested in discussing purely financial bubbles (e.g. US student debt). I’m interested in using the technology lens to spot upcoming opportunities that might make good investments.

What Bubbles Are Made Of

In the 2010s, the most important bubble was the crypto bubble: Bitcoin (BTC) (2H2017) and Initial Coin Offerings (ICO) (until 2Q2018).

Bubbles often represent the best opportunity to capitalize on innovation. They attract capital and talent into a speculative area of technology.

Bubbles can provide the fuel for ecosystems to develop around an innovation. Sometimes they herald the transition from the innovation to the deployment phase of a technology. Bubbles, in other words, are more important than the return they provide to speculators.

For a bubble to form, we need (a) some sort of financial product that is broadly accessible, (b) a fantastic story based on inflated expectations that is broadly covered by the media and, as a result (c) a critical mass of retail investors that are attracted by the product’s prospects and motivated by FOMO or greed.

This is when irrational behavior drives rapid capital inflow into an asset or asset class and forms a bubble.

But to return to the initial question: Where might bubbles emerge in the decade ahead?

After considering several sectors and industries, I’ve come up with two likely candidates:

- Biotech

- The Space Industry

Please let me know on Twitter if you disagree with my conclusions, or if you have identified additional candidate assets or industries.

Biotech Bubble Speculation

I believe that Biotech is a prime candidate for a bubble.

Before the end of the 2020s, the baby boomer generation born between 1946 and 1964 will have reached retirement age. This is important, because the Boomers are the wealthiest generation.

They want to enjoy retirement. At the same time, they’re aware that the incidence of disease grows with age. This puts health at the top of their agenda.

When it comes to a potentially credible biotech story, any specific therapy is usually too complex to understand and will lack mass appeal.

However, a general story that’s already gaining traction and absolutely has mass appeal is the story around longevity.

Imagine that you could take a pill that would halt aging and allow you to fully enjoy your retirement. You could see your grandchild Max graduate from high school, and celebrate your diamond wedding anniversary (60 years) on the island you visited when you were newly engaged.

Longevity offers a simple and alluring promise with broad appeal. The market potential of a longer life is infinite!

Any real breakthrough in longevity would probably require a platform innovation that is applicable across diseases and would also provide use cases outside of healthcare. Synthetic foods and materials will play a role in the media, albeit a much smaller one than the longevity claims.

Another thing helping the longevity story is that it is complex. The underlying biology and systemic approach it will likely require pares down the number of people who actually understand the subject to only a few. These experts will be scientists who have been working in the area for decades. They won’t be able to control the narrative once the bubble starts.

Because longevity is so complex and there will be only a few genuine experts, it will allow savvy investors to appear smart while pushing their interests: “Have you seen this RNA binding complex programmer? It will totally change the world!”

In addition to the story’s potential size and mass appeal, an accessible financial product is required for a bubble to form. Biotech is also a prime candidate in this regard.

Biotech companies usually go public during their development stage, many years before their product hits the market. This, of course, provides more space for speculation.

Usually, the company has finished its pre-clinical development work, where a compound is tested in the lab before it goes public. If human clinical trials have been conducted, in almost all cases, these were Phase 1. These trials don’t say much about efficacy, as their goal is to test toxicity and provide more information on further development.

By definition, establishing a truly beneficial drug for longevity would require very long and expensive clinical trials. This is why, in the lab, organisms with short life spans such as cells, worms, flies, fish, and rats are chosen. Lab results from these model organisms often cannot be directly transferred to humans.

Because humans live much longer than these species, longevity companies would aim for a surrogate marker in human trials, such as inflammation or mitochondrial “health”. This would make it even harder to evaluate the merit of their promises. Despite all this, these companies would be public and more than happy to accept retail investors’ money.

Is it too difficult to pick a single biotech company to invest in? Biotech ETFs exist to allow people to bet on the sector or its sub-sectors (e.g., healthcare). I can easily imagine a longevity ETF that would provide prime exposure to the longevity hype thesis.

Space Bubble Speculation

The space industry is another likely candidate for a bubble.

Let’s first think about the story and mass appeal.

Space is the final frontier. It’s the place where no man has gone before. It is infinite.

Instruments register only through things they’re designed to register. Space still contains infinite unknowns. – Mr. Spock, “The Naked Time”

Space offers infinite potential. I don’t expect that we will reach the ability to mine asteroids or even travel to the closest known habitable exoplanet, or establish a permanent outpost on Mars within the next 10 years.

However, in terms of story potential, the modern version of a very old trade could work well.

Around 1.000 years ago, medieval Venice and Florence were the leading global powerhouses of trade. Even several hundred years later, it was no coincidence that Shakespeare located his merchant in Venice, and not in London or Athens.

Medieval merchants in Venice invented two important pillars of our capitalist system: carried interest, and the limited liability corporation.

In medieval times, ship captains set sail for the end of the (known) world to reach new lands and find treasure. These adventures could be exceedingly profitable investments. As the Wall Street Journal writes:

Sir Francis Drake took nearly three years to go around the world, but the voyage yielded a profit of about 500,000 British pounds – twice the annual revenue of the crown in the days of Queen Elizabeth I.

Long-distance trade was really risky. Many crews and ships never returned. But once in a while, an enterprising captain who could raise the money for his endeavor could more than double his money when returning from Constantinople.

Since space is wide open, the race is on to become the East India Space Co.

Enterprising space entrepreneurs could set up public investment vehicles to finance their travels to other planets.

The current space story revolves around space tourism (Virgin Galactic) and satellite communication (Space X Starlink). While I believe that both enterprises can be successful, I don’t think they have bubble potential. Both stories lack the inspiration and dreamlike potential required to get the bubble frenzy started.

An alternative story, albeit a weaker one, could revolve around space thematically.

We just don’t know what’s out there. However, we do know that many more resources exist in space than on Earth. So venturing out there can be lucrative. In light of the imminent danger that global warming presents, it might even be necessary for humans to leave Earth.

This will require a broad effort across the complete space technology value chain: From spaceports and rocket systems, to astronaut suits.

Conveniently, the first ETF exclusively focused on “space” launched in April 2019. The Procure Space ETF is highly marketable. Their symbol is $UFO. They also have some clever ads on their website that read, “It’s a small world…invest beyond.”

Disclaimer: You’re reading this on the internet! If you had listened to your parents, you’d know that you can’t believe anything online. For all you know, this post could have been written by a pecan, or an otter, or even a manatee underwater. So the content should not be construed as or relied upon in any manner as investment, legal, tax, or other advice.